Why Choose FlowMatriX ?

04

04

04

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Click Trading

Execute orders instantly from the DOM displayed directly on your chart. Click any price level in the depth-of-market ladder to place trades. Full order book data integrated into your chart for seamless one-click trading.

Vertical Scroll

Navigate through price levels effortlessly with your mouse wheel. Scroll up or down to explore deeper market depth while staying focused on price action and the liquidity levels that matter most to your trade.

Auto Scale

Switch seamlessly between DOM cell view and dual trading bands mode, the display automatically adjusts to maintain optimal visibility. The interface scales intelligently to fit your workflow.

Tape Reader

See every trade instantly with ultra-fast display. Price, volume, time — all essential data at your fingertips.

Sweep Detection

Automatically identifies directional sweeps and absorptions. Color-coded rectangles on the chart to instantly spot key zones.

Volume Bubbles

Graphical visualization of large trades with bubbles sized proportionally to volume. Smart merging of nearby trades for better clarity.

Live Statistics

Real-time delta, Buy/Sell ratios, cumulative volume — all the metrics you need for informed decisions.

Sound Alerts

Never miss a critical event! Customizable alerts for sweeps and large trades, with configurable sounds.

Full Custom

Colors, sizes, symbols, opacity — every aspect is configurable to perfectly match your trading style.

Core Features

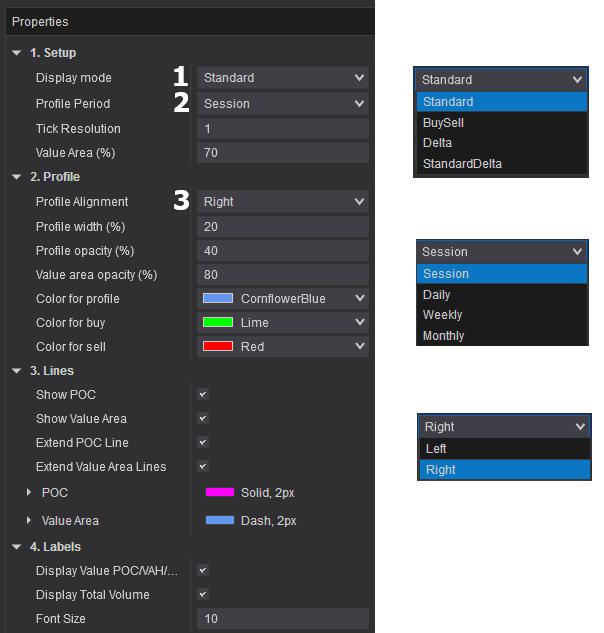

Multiple Display Modes

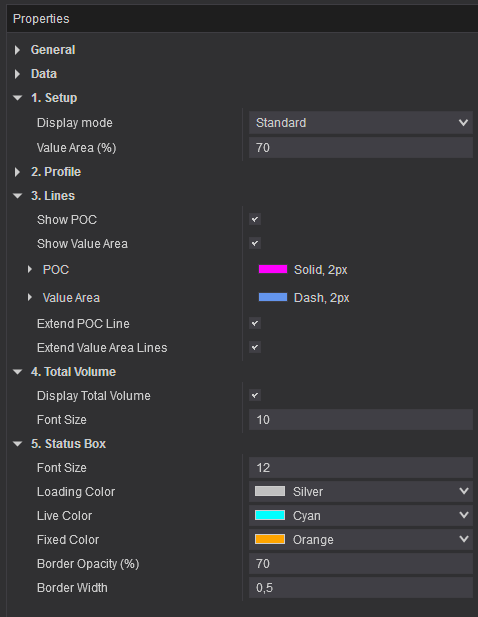

- Standard: Total volume distribution

- Buy/Sell: Separated buyer and seller volume

- Delta: Net buying/selling pressure

- Standard + Delta: Combined analysis view

Automatic Level Detection

- Point of Control (POC): Highest volume price level

- Value Area: Configurable zone containing 70% of volume

- VAH/VAL: Value area boundaries

Dynamic Extensions POC and Value Area lines automatically extend until price crosses them, allowing you to track untested levels in real-time.

Flexible Timeframes Build profiles by Session, Daily, Weekly, or Monthly periods with configurable tick resolution for precise high-frequency analysis.

Core Features

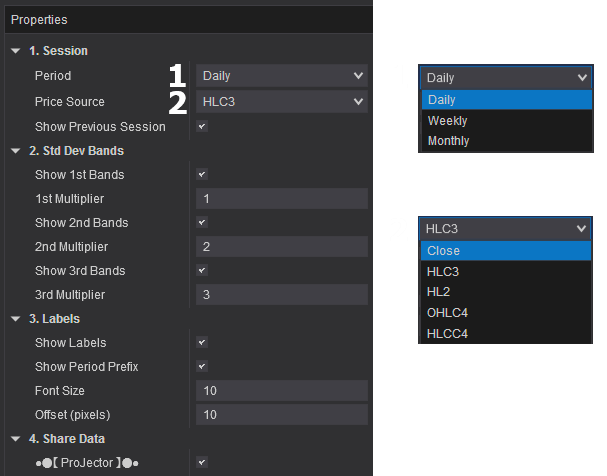

Multiple Period Types

- Daily: Reset at each session start

- Weekly: Reset at week beginning

- Monthly: Reset at month start

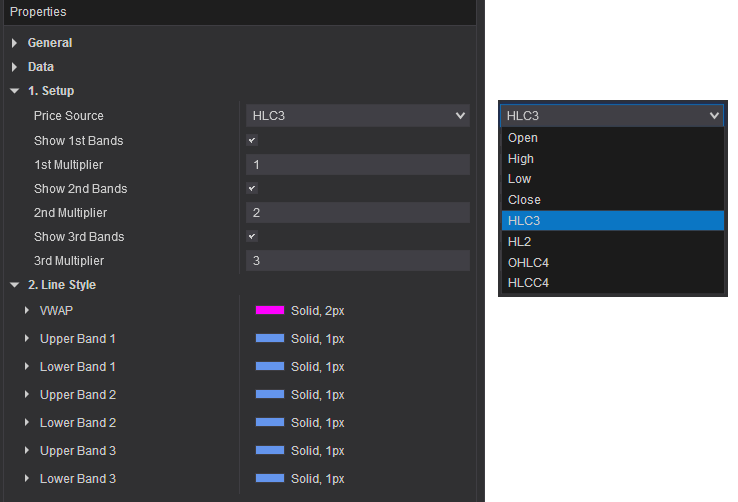

Standard Deviation Bands Three configurable sets of standard deviation bands (1σ, 2σ, 3σ) to identify price extremes and potential reversal zones. Customize multipliers for each band set to match your trading style.

Previous Session Levels Display previous period VWAP and bands to identify reference levels from prior trading sessions. Track how current price action relates to previous fair value zones.

Flexible Price Sources Choose from multiple calculation methods: Close, HLC3, HL2, OHLC4, or HLCC4 to match your analysis preference.

ProJector - Multi-Timeframe VWAP Display

A Unified View Across Time Horizons

The FlowMatriX ProJector serves as a thoughtful companion to the VWAP indicator, bringing together Daily, Weekly, and Monthly perspectives within a single view. Rather than calculating these levels independently, ProJector receives prepared data from your existing VWAP instances, allowing you to maintain a comprehensive multi-timeframe awareness without additional computational burden.

What ProJector Offers

Perspectives Across Time ProJector brings together intraday, weekly, and monthly VWAP levels alongside their standard deviation bands, creating a layered view of how different market participants perceive value across various time horizons.

Memory of Past Sessions Beyond current levels, display up to 1000 historical periods for each timeframe, preserving the context of where fair value resided in previous sessions and how those zones continue to influence price behavior.

Temporal Context Optional age labels help you understand the recency of historical levels, marking them as one, two, or three periods removed from the present—a subtle but useful reference for gauging relevance.

Efficient Architecture Through the DataHub system, pre-calculated values flow from your VWAP indicators rather than being computed redundantly. This design allows extensive historical context without the performance costs typically associated with such rich visual information.

Selective Visibility Each timeframe can be shown or hidden independently, as can the distinction between current and historical levels, letting you adjust your view to match the specific context you're observing.

The Value of This Approach

Markets operate across multiple timeframes simultaneously. ProJector helps you see how shorter-term price action relates to longer-term fair value anchors, revealing moments of alignment or tension. Previous VWAP levels often remain relevant long after their originating period has closed, acting as significant reference points that ProJector maintains without cluttering your workspace.

The shared data architecture prioritizes efficiency—a single calculation informs multiple displays. This thoughtful resource use allows you to build richer analytical views while maintaining chart responsiveness, with independent timeframe controls that let you refine your perspective fluidly as market conditions evolve.

Getting Started

Add VWAP indicators configured for your desired periods—typically Daily, Weekly, and Monthly. Enable data sharing on each instance, then add ProJector to gather and display all shared information. Finally, adjust visibility and historical depth settings to suit your analytical preferences.

Technical Characteristics

Optimized rendering with configurable line extension and visual styling inherited from source VWAP indicators ensures consistency across your analysis. The design particularly suits multi-monitor trading environments where maintaining coherent reference levels across different chart views becomes important.

The Anchored VWAP tool lets you calculate volume-weighted average price from any point on your chart, essential for tracking institutional positions and understanding fair value from key market events.

Key Features

- Flexible Price Sources: Choose from 8 calculation methods (HLC3, HLCC4, OHLC4, HL2, or individual OHLC values) to match your analysis style

- Triple Standard Deviation Bands: Display up to three sets of standard deviation bands with customizable multipliers (default 1σ, 2σ, 3σ)

- True Volume Weighting: Uses actual tick-by-tick volume data for accurate VWAP calculation, not bar-based approximations

- One-Click Anchoring: Simply click any bar to start your VWAP calculation, perfect for anchoring to significant events like earnings, Fed announcements, or key reversals

- Clean Visual Design: Distinctive anchor marker with extending lines clearly shows your reference point

Perfect For: Tracking intraday institutional levels, identifying mean reversion opportunities, and understanding volume-weighted fair value from key market events.

The FlowMatriX Volume Profile reveals the hidden story behind price action by displaying volume distribution across price levels within any time range you define.

Key Features

- Dynamic or Fixed Modes: Lock your profile to live data for real-time updates, or fix it to analyze completed sessions

- Point of Control (POC): Instantly identify the price level with the highest traded volume, where institutional activity concentrates

- Value Area Analysis: Visualize the 70% value area (customizable) to understand where the majority of trading occurred

- Delta Profiling: Switch between standard volume display and buy/sell delta visualization to reveal directional pressure at each price level

- Line Extensions: Automatically extend POC and Value Area lines forward in time to track key reference levels

- Total Volume Display: See aggregate volume for the entire profile range at a glance

- Professional Status Indicators: Clear visual feedback shows whether your profile is loading, updating live, or fixed

Perfect For: Identifying support/resistance zones, analyzing auction market theory concepts, and understanding institutional order flow distribution.

Complete Range Analysis in One Tool

Combine volume distribution with volume-weighted pricing in a single, perfectly synchronized tool. VP ● VWAP gives you both Volume Profile and VWAP, anchored to the same starting point for unified market analysis.

Key Features:

- Synchronized Anchoring – Profile and VWAP share the same left anchor, ensuring calculations align perfectly across your selected range

- Full Volume Profile – POC, Value Area, buy/sell delta visualization, line extensions, and real-time status indicators

- Complete VWAP System – Three standard deviation bands with adjustable multipliers and flexible price source options

- Adaptive Extension – Extend VWAP lines forward or keep them within the profile zone to match your workflow

- Auto Mode Detection – Instantly recognizes live vs. fixed ranges and updates accordingly

Ideal for identifying high-probability zones where volume structure converges with volume-weighted pricing levels.

Collaborative Community

FlowMatriX grows through the voices of traders at every level. Our Discord community is where curious beginners meet experienced analysts, and where your feedback directly shapes our tools.

What You'll Find

Direct Developer Access – Questions about setup, configuration, or how a feature works? Get answers straight from the team that builds FlowMatriX.

Learn from Others – See how traders use the tools across different markets and strategies. Share your discoveries and learn new approaches.

Trading Discussions – Beyond tool configuration, discuss order flow, volume analysis, and market concepts with traders who love diving deep into market structure.

Whether you're just starting with volume analysis or you've been reading the tape for years, you'll find your place here.

Free Pack

Premium Pack